Investment Principles

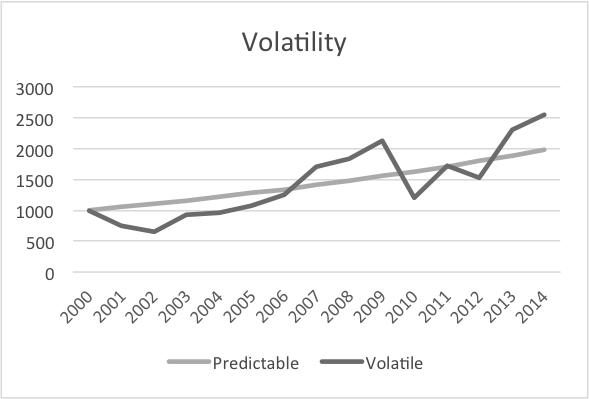

With investment generally the more risk you are prepared to accept will lead to higher returns over the long-term but also normally means more volatility (up and down movements) which can be very scary to the inexperienced investor and may mean you making bad decisions should your investments fall unexpectedly.

Investing in cash and bonds to deliver a predictable return may seem prudent but over the long-term inflation could wipe out any gains you make whereas investing in property and shares is likely to give you a return over the long-term significantly above inflation, making your money work harder for you but you have to live with the increased volatility.

Combining different types of investment (property, shares, bonds and cash) via an asset allocation model can help to even out these swings in value, especially if they are "non-correlated" (i.e. their prices move independently). This is why it usually makes sense for investors to have some exposure to bonds and cash even though their long-term potential is less than that of property and shares.

The asset allocation of a portfolio has a direct impact on the level of risk as does the timeframe for investment. If you need the money in three years’ time, you should take much less risk than if you intend to invest for twenty years.

We will help determine the risk you are prepared to take, talk about the options for maximising your return within your risk tolerance and then select a suitable model portfolio with you. Our investment models reflect your financial goals, attitude to risk and your investment timeframe. We invest in a range of asset classes, spreading your investments and thereby reducing your risk.

Also See -

Passive Vs Active Management Lifestyle and Target Date Funds

Eight Steps Towards your Personal Investment Strategy

1. Getting to know you

Wealth management is very much about forging strong, long-ter m relationships. This is best initiated by our getting to know one another. On this basis of thorough understanding, we can help our clients achieve their goals. Establishing a rapport and ensuring you feel comfortable with our proposition is important to us and to the foundations of your investment plan. Your first opportunity to get to know us is by meeting with a Wheeler Wicks & Company Advisor. It is at this meeting that you will also receive Terms of Business which sets out the services offered and charges levied.

m relationships. This is best initiated by our getting to know one another. On this basis of thorough understanding, we can help our clients achieve their goals. Establishing a rapport and ensuring you feel comfortable with our proposition is important to us and to the foundations of your investment plan. Your first opportunity to get to know us is by meeting with a Wheeler Wicks & Company Advisor. It is at this meeting that you will also receive Terms of Business which sets out the services offered and charges levied.

2. Analysing your need

Investment strategy and objectives are entirely individual. All clients differ in this respect, and in examining need, we are focused on individuality. Wheeler Wicks and Company prefers a flexible, yet thorough approach to fact-finding, which works to discover the uniqueness of the requirement. Gaining a clear view of your aims and needs from your investment is vital to its success.

3. Fixing the portfolio aims

Among the factors we consider when determining the portfolio aims are your objectives and the desired time horizon. An appropriate benchmark is chosen to use as a roadmap to maximize the probability of achieving these objectives. Benchmarks enable clients to gauge the performance of their portfolio whilst providing a framework for responsible investment management and the control of associated risk. Once a benchmark has been agreed, we will encourage our clients to stick with it. Frequent changing of benchmarks can lead to poor investment decisions.

4. Deciding the asset mix

The investment asset mix – equities, bonds, cash and property – will have a major impact on returns over the long-term. We believe the asset allocation is the most important factor affecting performance in any portfolio; deciding the equities, bonds and cash reserve, therefore, is the single most important decision.

5. Shaping your investment portfolio

Having determined the asset mix, which is approximately 70% of the decision-making process, we will decide upon the sub-asset allocations. Whether, for example, to invest in foreign or domestic stocks, what markets to invest in, the relative size and valuation of the equities, and so on. Once this structure is in place, we will look to determine the security selection, which we believe has the least impact on investment portfolio performance.

6. Tax efficiency

We do not hold any of our clients' assets. We use the most tax efficient products suitable for your circumstances in order to optimise your returns of your investment portfolio. We may use offshore investments where appropriate.

7. Proactive management

We do not limit ourselves to a single investment style since we think that this closes doors on consistent gains: our approach to investments is flexible, proactive and dynamic. Tying ourselves to one investment approach restricts the opportunity for maximising performance. Our strategic investment style strives for steadier navigation through difficult times as well as benefiting from buoyant markets.

8. Reporting back to you

Managing investment portfolio accounts proactively brings with it the responsibility of keeping clients up to date and well informed as to how their investments are working. Communication is the bedrock of our service to clients. Clients are issued with six monthly reports, but maintaining transparency through clear and personal reporting is fundamental to our picture of the investment partnership.

If you would like more information, or would like to make an enquiry, click here.